The global financial landscape is undergoing a profound transformation, driven by technological advancements and shifting economic paradigms. The rise of generative artificial intelligence (AI) has significantly reduced the cost of labour across industries, challenging the traditional role of currencies as a “storage of labour”. As direct labour’s contribution to economic value diminishes, currencies such as the US dollar (USD) are transitioning toward a “storage of value” - a shift that prioritises stability and utility in transactions over reliance on labour taxation. Within this context, US dollar-backed stablecoins (digital assets pegged to the US dollar) are emerging as a dominant global medium of exchange. Supported by regulation such as the GENIUS Act of 2025, stablecoins offer portability, impressibility, divisibility, fusibility and taxability, whereby aligning with the key attributes of an ideal medium of exchange. US stablecoins are rapidly becoming the global medium of exchange, analysing their economic and technological advantages, policy support and alignment with the evolving definition of currency.

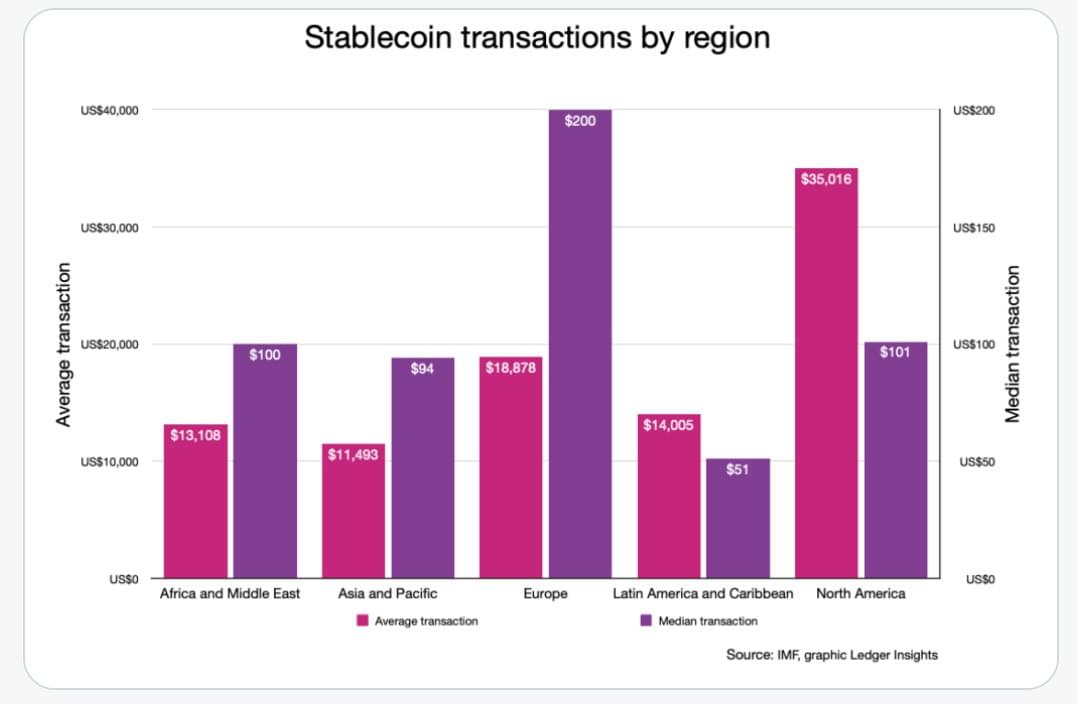

IMF blockchain analysis confirms stablecoins are flowing from the US to the rest of the world: North America is the top source of digital dollar outflows.

Source: Real World Asset Watch list

The economic context: from storage of labour to storage of value

Historically, currencies such as the US dollar derived their value from the taxation of labour and the backing of national treasuries, functioning - essentially - as a “storage of labour”. Workers’ economic output underpinned the currency’s value, with taxes obligated to be paid in the national currency, thus ensuring demand for the currency to settle obligations. However, AI’s relentless drive to reduce labour costs (along with the related rise in robotics) has disrupted this model. As AI automates tasks across all professions, labour’s economic contribution shrinks, so potentially leading to wage deflation and reduced consumer spending. This threatens currencies’ stability, as their value as a store of labour weakens. Central banks may inflate currencies to offset labour devaluation, risking economic stagnation. To counter this, the US government is managing the US dollar's transition to a “storage of value”. Key evidence includes:

· global deployment of US dollar's stablecoins - the GENIUS Act of 2025 promotes US dollar-backed stablecoins, enabling their use worldwide and reinforcing the US dollar's role as a stable store of value.

· banning of other stablecoin competitors - central banks or other countries treasuries using CBDCs (another word for stablecoin) are excluded from the US financial system by Executive Order.

· reducing and potentially eliminating personal income taxes - the proposed elimination of personal income taxes (initially for those earning below $50,000 USD) reduces reliance on labour-based revenue, signalling a shift away from labour as the primary value driver.

· tariffs on imports - replacing tax revenue with tariffs on imported goods diversifies the US dollar's value base, focusing on trade and economic activity rather than labour.

· exclusive US tax jurisdictions - aggressively policing other countries' fiscal tax policies against US global digital companies.

This transition aligns with the definition of a medium of exchange as “the least depreciating asset over the longest period of time”, with attributes such as portability, impressibility, divisibility, fusibility and taxability. US dollar stablecoins excel in these areas, making them ideal candidates for global adoption.

Why US dollar stablecoins are ideal as a medium of exchange

US dollar stablecoins, such as Tether (USDT) and USD Coin (USDC), are digital assets pegged 1:1 to the US dollar, backed by reserves such as cash and Treasury securities. Their rapid rise $260 billion in global circulation by 2025 reflects their alignment with the criteria for a medium of exchange, including:

- portability - stablecoins operate on blockchain networks, enabling near-instantaneous, low-cost transfers across borders. Unlike physical cash or gold, which incur high transport costs, stablecoins can be sent globally with minimal fees and delays - “the least costs of moving and transmitting over long distances.”

- impressibility - blockchain technology ensures stablecoins are easily authenticated, with transactions recorded on immutable ledgers. This minimises counterfeiting risks and verification costs, unlike physical currencies or representative money (e.g., gold certificates) which require time-intensive authentication.

- divisibility - stablecoins are highly divisible, allowing transactions in fractions of a cent (e.g., 0.0001 USDC). This surpasses physical currencies or commodities such as gold - which are less flexible for microtransactions - and dividing into “smaller parts of equal value”.

- fusibility - stablecoins can be combined into larger units without loss of value, as their digital nature allows seamless aggregation.

- taxability - stablecoin transactions are traceable on public blockchains, enabling tax authorities to identify and tax transactions (e.g., ad valorem or ex valorem). Ease of taxability is a key attribute, allowing governments to collect revenue without relying solely on labour taxes.

These attributes make US dollar stablecoins superior to traditional money (e.g., gold, silver) or representative money (e.g., historic banknotes), which lack the same level of digital efficiency and scalability. Unlike a central bank digital currency (CBDC), banned by US Executive Order on January 23, 2025, stablecoins are private-sector innovations whereby avoiding centralised control and aligning with the US government’s preference for decentralised financial solutions.

Policy support and global adoption

The US government’s strategic policies are accelerating the global adoption of US dollar stablecoins. The GENIUS Act of 2025 facilitates their integration into international economies, encouraging foreign merchants and consumers to accept US dollar stablecoins for transactions. This builds on the US dollar's status as the world’s primary reserve currency (58% of global foreign exchange reserves, per IMF 2024), extending its reach through digital means. The Executive Order banning CBDCs further promotes private stablecoins, with Federal Reserve Governor, Christopher Waller, noting their potential to strengthen US dollar's dominance without government overreach. By fostering a regulatory framework for stablecoins, the US ensures they remain lawful and widely accepted, enhancing their role as a global medium of exchange.

AI’s role and economic implications

AI’s impact on labour value is accelerating the need for stablecoins. By 2028, AI could automate 25% of US jobs (Goldman Sachs, 2023), reducing labour’s economic contribution and threatening the US dollar's role as a store of labour. Stablecoins mitigate this by anchoring the US dollar's value to reserves and global demand, not labour output. Their digital nature supports AI-driven economies where fast, low-cost transactions are critical. For instance, stablecoins enable seamless payments in AI-powered platforms, from e-commerce to decentralised finance (DeFi), ensuring the US dollar remains relevant as a store of value. However, this transition carries risks. As a currency becoming a pure “storage of value” can lead to hoarding, as seen in the 1890s and 1930s, so stifling economic activity. Stablecoins counter this by maintaining transactional utility, encouraging spending over hoarding due to their ease of use and global acceptance. Yet, their widespread adoption could exacerbate inequality if AI-driven unemployment outpaces reskilling, as only those with access to digital infrastructure fully benefit.

US dollar's stablecoins are fast becoming the global medium of exchange due to their alignment with the economic and technological demands of an AI-driven world. Their portability, impressibility, divisibility, fusibility and taxability make them ideal for transactions, surpassing traditional and even old fashioned representative money. Supported by US policies such as the GENIUS Act and the CBDC ban, stablecoins extend the US dollar's global dominance while adapting to the transition from a “storage of labour” to a “storage of value”. By leveraging AI’s efficiencies and mitigating labour devaluation risks, US dollar stablecoins ensure the US remains a financial leader, collecting tax benefits at the expense of other nations’ fiscal control. However, careful regulation and reskilling efforts are needed to prevent inequality and economic stagnation, ensuring stablecoins fulfil their potential as the world’s preferred medium of exchange.

This article first appeared in Digital Bytes (19th of August, 2025), a weekly newsletter by Jonny Fry of Team Blockchain.