For decades, dark pools have been the quiet machinery of institutional trading, allowing banks, asset managers and hedge funds to move billions without tipping their hand to the wider market. First emerging in the 1980s with platforms such as Instinet, they have since become a core pillar of equity markets. By April 2019, nearly 40% of US equity trades by volume occurred “in the dark”, underscoring their central role in market infrastructure. The purpose was clear: prevent large trades from causing volatility. Without dark pools, a large institutional trade worth billions could trigger a price collapse before execution completes but by matching orders off the visible books, dark pools preserve liquidity, minimise slippage and often deliver better execution. Today, however, the conversation has expanded far beyond Wall Street. As crypto matures, institutions are experimenting with digital dark pools. Binance’s co-founder, Changpeng Zhao (CZ), recently argued that decentralised dark pools could protect traders from manipulation and front-running in decentralised finance. The debate is no longer whether dark pools are necessary, but whether their evolution will make markets fairer or deepen their fragmentation. Dark pools are alternative trading systems (ATS) where participants can execute large orders anonymously. However, unlike traditional exchanges, these venues do not display order books or pre-trade data. Orders are only revealed after execution, often reported with a delay to consolidated tapes. Originally designed to shield institutions from slippage, today’s dark pools fall into three main categories:

· broker-owned pools - such as Goldman Sachs’, Sigma X, often criticised for conflicts of interest.

· exchange-operated pools - where public exchanges run parallel hidden markets.

· independent pools - such as Liquidnet, specialising in block trades for asset managers.

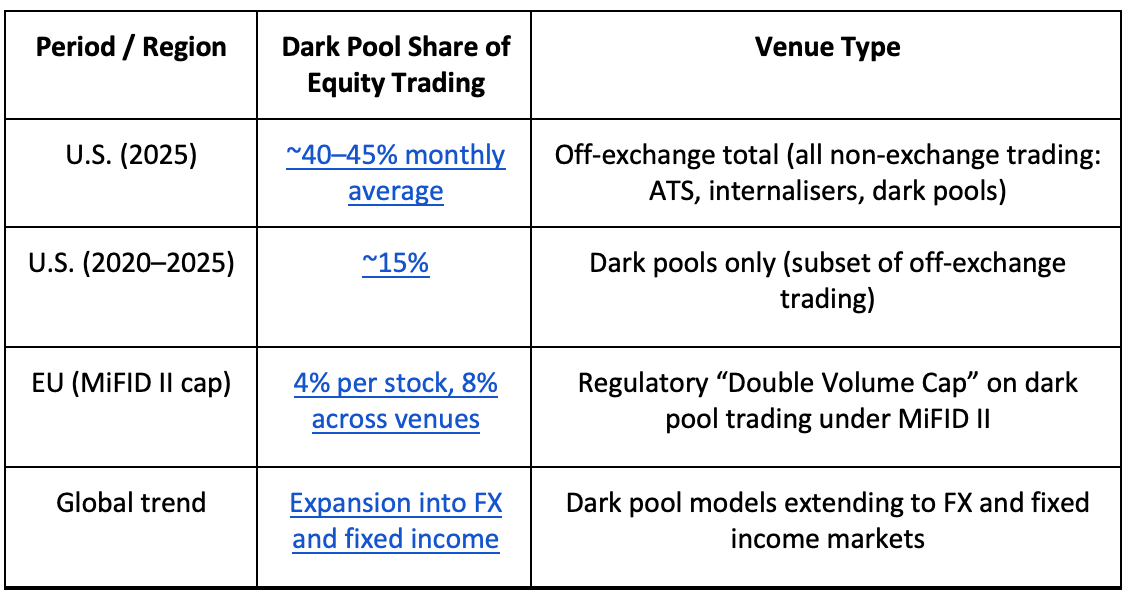

The technology behind these venues has also matured - matching engines randomise order timings and sizes to disguise intentions and some pools use midpoint pricing based on the national best bid and offer (NBBO), ensuring clients do not consistently lose out to market makers. In addition, whilst exact figures vary depending on methodology, dark pools consistently handle a significant share of trading. The divergence in estimates reflects different definitions and data collection methods. Some regulators count only reported block trades, while others include all off-exchange internalisation

Source: Teamblockchain

Trading in the shadows - advantages and pitfalls of dark pools:

Dark pools offer significant advantages for institutional traders; by executing large orders away from public markets, they:

· reduce market impact - large trades can be executed without causing sudden price swings.

· lower costs - internal matching often produces better fills than fragmented exchange venues.

· preserve confidentiality - trading intentions remain hidden from rivals and high-frequency traders.

And there is empirical evidence to support these benefits - for example, BlackRock has reported that dark pool trading can cut implementation shortfall by up to 25 basis points and Maureen O’Hara of Cornell estimates cost savings of 20-30% under optimal conditions. However, dark pools do also carry notable risks, including:

· market fairness - retail investors rarely gain access, creating a two-tier system.

· transparency issues - delayed reporting reduces informational efficiency and weakens price discovery.

· conflicts of interest - broker-operated pools may prioritise internal flows over client interests.

Regulators have responded with:

· the SEC and New York Attorney General fining Barclays $70 million for misleading investors about high-frequency trader access to its dark pool.

· the EU’s MiFID II introducing strict caps whereby limiting dark trading to 4% of daily volume per stock and 8% across all venues, though temporary waivers created loopholes.

· the World Economic Forum warning that excessive reliance on dark pools can weaken market confidence and distort visible pricing.

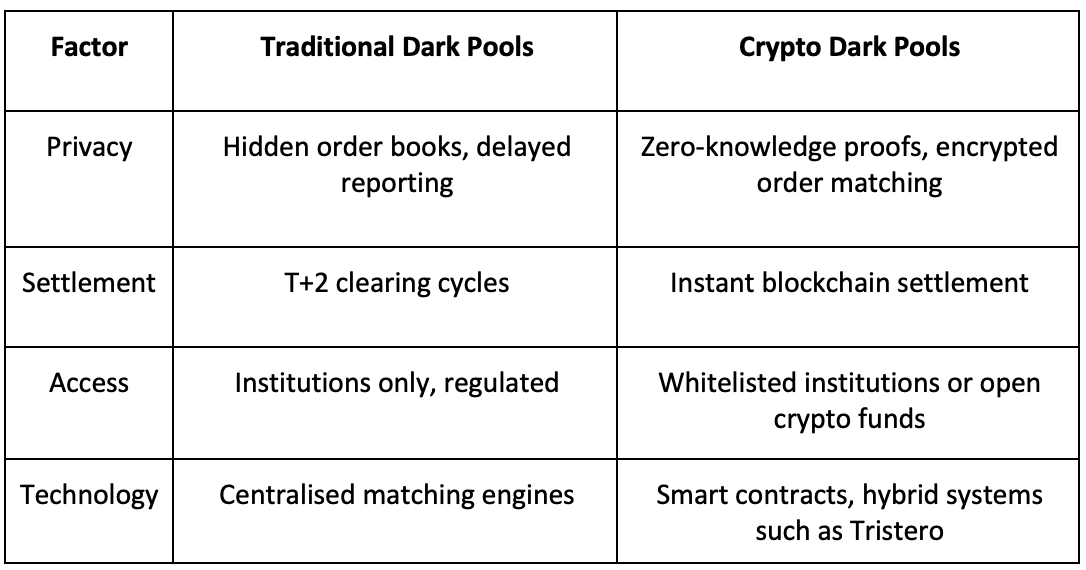

Certainly, the emergence of crypto dark pools mirrors the benefits and risks of their traditional counterparts. Yet these venues remain largely opaque, potentially disadvantaging retail participants and creating challenges for cross-border oversight, market integrity and liquidity fragmentation. Moreover, crypto markets, characterised by volatility and manipulation risks, are now experimenting with dark pool mechanics. By adapting cryptographic tools, decentralised dark pools seek to combine privacy, liquidity and trustlessness. Unlike traditional dark pools, crypto venues use blockchain and advanced verification to enhance trust and limit manipulation. Platforms such as sFOX consolidate liquidity across exchanges and OTC desks - for example, an institutional trader can execute a large BTC order on sFOX without moving the market, whilst stablecoins ensure instant settlement and reduced counterparty risk. Tristero, a company focused on developing decentralised dark pool technology and aiming to create a fairer trading environment, runs autonomous, smart contract-based pools that execute only when counterparties exist whereby allowing large, tokenised asset trades, such as a portfolio of tokenised corporate bonds, to occur off-exchange without disrupting market pricing. Smaller venues such as Kanga Exchange also aim to shield large trades from market disruption, with stablecoins and tokenised assets enabling faster, more liquid settlement.

Source: Teamblockchain

Stablecoins as liquidity fuel

Stablecoins, with a market capitalisation surpassing $250bn, are becoming the base currency for crypto dark pools. Their programmability allows settlement rules to be embedded directly in code, from conditional releases to algorithmic splitting of trades. Analysts project stablecoins could reach a $2tn market by 2028.

Tokenised assets and hidden liquidity

Tokenisation is another driver. Real-world assets such as real estate, bonds and fine art are being digitised into tradeable tokens. Dark pools could allow institutions to swap sizeable positions in these assets without disrupting markets, while stablecoins provide immediate settlement. This creates opportunities for liquidity in markets that were once illiquid. Industry leaders and regulators remain divided on the role of dark pools. Binance co-founder Changpeng Zhao (CZ) has argued that decentralised dark pool exchanges could shield large traders from manipulation and front-running in decentralised finance, presenting them as a safeguard against some of crypto’s most persistent problems. By contrast, Gary Gensler, ex Chair of the US Securities and Exchange Commission, has warned that when trading shifts into opaque venues, regulators must ensure that rules of fair access and transparency are not undermined. Adding an academic perspective, Maureen O’Hara of Cornell University has noted that while the cost savings for institutions are clear, dark pools inevitably weaken the informational role that public markets provide. These contrasting viewpoints highlight the central tension: whether dark pools will mature into efficient, stability-enhancing tools or continue to fuel concerns about fairness and market opacity.

The fusion of stablecoins, tokenised assets and programmable contracts is paving the way for a new generation of digital dark pools. In an optimistic scenario, these platforms could reduce market volatility by shielding large orders from public order books, enable round-the-clock global settlement via blockchain and attract substantial institutional capital to the crypto ecosystem. For example, a hedge fund executing a large stablecoin-backed token swap across multiple exchanges could maintain price stability whilst accessing deeper liquidity pools - a feat far harder in public venues. Yet the risks remain significant - poorly managed digital dark pools could deepen market inequalities, privileging large players over smaller participants. Liquidity may fragment across multiple hidden venues and opaque trading could obscure price discovery, undermining market confidence. Cross-border oversight and manipulation prevention remain unresolved challenges and institutions entering crypto dark pools should carefully weigh potential liquidity and execution benefits against fairness, transparency and regulatory risks. Essentially, the most successful implementations will combine technological innovation with robust governance, ensuring that these hidden markets complement rather than undermine broader market integrity.

This article first appeared in Digital Bytes (7th of October, 2025), a weekly newsletter by Jonny Fry of Team Blockchain.