The constant threat of inflation and continued economic volatility are reshaping global financial strategies. From the lingering effects of COVID-19 and quantitative easing to geopolitical tensions and the huge piles of government debt and banking sector fragility, investors are actively seeking reliable stores of value. Amidst this uncertainty - Bitcoin has increasingly been viewed as “digital gold”, a decentralised asset with the potential to preserve wealth. Once deemed speculative, Bitcoin is now gaining institutional interest and being compared to gold for its scarcity, decentralisation and supply cap. But can it truly serve as a hedge against inflation and economic turmoil? As asset manager, Julius Bear, has reminded us: “One of gold’s most appealing characteristics is its ability to protect against inflation over the long term. Due to the effects of inflation, currencies lose their value over time. A good example of this is changes in house prices. Back in 1929, the average house price in the US was around USD $6,500. Fast-forward to 2024 and the average house price shot up to around USD $420,000, showing just how much a dollar has fallen in value over that period. However, in 1929, 10kg of gold was worth around USD $7,300 - just enough to buy the average house. But by 2024, the same amount of gold was worth around USD $830,000 - nearly enough to buy two houses.”

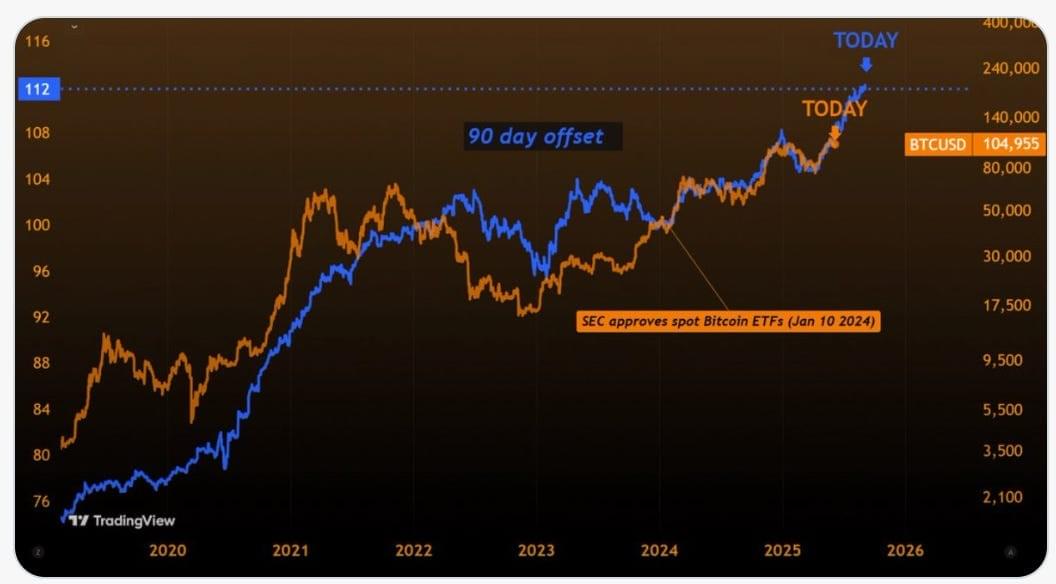

Since the BTC ETF was launched, Bitcoin’s price has tracked US money supply

Source: X

Gold has long been seen as a monetary safe haven, especially during inflationary periods. Its ability to store value stems from its scarcity, independence from central banks and centuries of global trust. And Bitcoin, whilst newer, shares many of these attributes. It has a capped supply of 21 million coins, is decentralised by design and offers censorship resistance. According to Monetary Authority of Singapore: “Economists often describe inflation as the result of ‘too much money chasing too few goods’”. Which if this is the case, as money supply has increased if Bitcoin were an inflationary hedge, you would expect to see the price of Bitcoin rise. As the above chart shows, this is exactly what has happened. In its report (Bitcoin First Revisited), Fidelity believes Bitcoin should be evaluated independently from other digital assets. The report argues that Bitcoin’s transparent monetary policy, immutable supply and robust network security make it a unique contender for the role of “digital gold”. In addition, its programmability and portability add layers of utility not found in traditional assets. Historical price movements also lend weight to this view. During the COVID-19 market turmoil in 2020, both gold and Bitcoin experienced significant gains as investors fled from fiat risk. And in 2021, amidst inflationary pressures, Bitcoin’s returns outpaced gold’s - albeit with greater volatility. Fair to say that these dynamics continue to shape Bitcoin’s growing reputation as a modern inflation hedge.

The maturing market has also attracted heavyweight institutions - BlackRock’s iShares Bitcoin Trust was one of the most successful ETF launches, marking a watershed moment in legitimising Bitcoin exposure. Similarly, Fidelity offers custodial services and access for clients, helping bridge traditional finance and crypto. Meanwhile, the US publicly-quoted company, MicroStrategy, remains a high-profile case study, converting over $5 billion of corporate treasury into Bitcoin. CEO, Michael Saylor, frames Bitcoin as a superior store of value over cash and bonds, citing inflation erosion. Furthermore, family offices and high-net-worth individuals are increasingly seeking direct or fund-based exposure to Bitcoin; the approval of US spot Bitcoin ETFs in 2024 has opened regulated channels for capital inflows. The ETF-isation of digital assets also represents a key step in mainstream adoption, particularly for institutional portfolios looking to diversify against inflation. Certainly, on-chain data offers valuable insights into how Bitcoin is being used. Metrics such as HODL waves and realised capitalisation show a growing share of Bitcoin being held long term. Notably, data from Glassnode and IntoTheBlock indicate that increasing numbers of coins are inactive for over a year, suggesting conviction-led ownership. For example, there is a wallet that had held Bitcoin since 2014, having bought 80,000 Bitcoins for $210,000, now worth $8 billion, and had not moved it from their wallet. However, at the end of June 2025, someone transferred his/her holding from this dormant wallet for some reason.

Meanwhile, supply held by short-term traders is at multi-year lows. Crypto exchanges are holding less 15% of Bitcoins’ current supply (the lowest their holdings have been for six years) whilst wallet distribution patterns reflect widening ownership and reduced concentration. These trends mirror gold’s behaviour, with a base of holders not actively seeking short-term gains but long-term preservation. And, although Bitcoin’s cyclical volatility is well documented, each successive cycle shows reduced drawdowns and higher post-recovery floors whereby indicating a maturing asset class. Indeed, Bitcoin is not without drawbacks - its volatility remains far higher than gold’s. In 2022 alone, it saw drawdowns of over 60%, whereas gold prices typically fluctuate within single-digit ranges. Regulatory pressures also loom large; the Bank of England has raised concerns about crypto’s systemic risks and the potential for investor losses without clear frameworks. In addition, the SEC’s piecemeal regulation has led to uncertainty in the US, although 2024’s ETF approvals marked a more defined stance. Meanwhile, environmental concerns around Bitcoin mining persist; proof-of-work validation consumes significant energy although efforts to shift to greener sources and second-layer solutions such as the Lightning Network offer partial relief.

It seems Bitcoin may not yet be a perfect hedge, but it is becoming a credible one. Whilst gold remains the traditional safe-haven, Bitcoin’s unique features, such as digital scarcity, borderless transferability and programmable structure, position it as a modern counterpart. It may not fully replace gold, but potentially could complement it in diversified portfolios especially for investors seeking protection against fiat depreciation and monetary mismanagement. With continued adoption, maturing regulations and the rise of tokenised financial infrastructure, Bitcoin’s role as digital gold looks increasingly durable. Clearly, the shift toward tokenised assets by firms such as Franklin Templeton, JP Morgan, and Société Générale supports this broader evolution. Real-world assets are moving on-chain and Bitcoin is already there, tested, traded and trusted. As the global financial system digitises, many already believe Bitcoin could well stand beside gold not as a rival but as a next-generation pillar of value preservation.

This article first appeared in Digital Bytes (22nd of July, 2025), a weekly newsletter by Jonny Fry of Team Blockchain.